In “Radical Overhaul” 20,000 Deutsche Bankers Will Be Fired As “Bad Bank” Soars To €80BN, 5x DB’s Market Cap

by Tyler Durden, published on Zero Hedge, on July 6, 2024

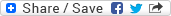

One month ago, Jeff Gundlach - in his latest DoubleLine investor call - cracked jokes that Deutsche Bank’s imploding stock, which has been hitting fresh all time lows virtually every day, had “major support” at €0.

Once again, he was on to something because just a few days later, the FT first reported that the bank which was this close to nationalization in 2016, and failed to consummate a merger with that “other” German bank, Commerzbank, was preparing to roll out Plan Z: amid a deep overhaul of its trading operations (read: mass terminations), the biggest German lender was set to roll out a “bad bank” holding some €50 billion in legacy toxic derivative assets, a plan that was quite popular in the depths of the global financial crisis.

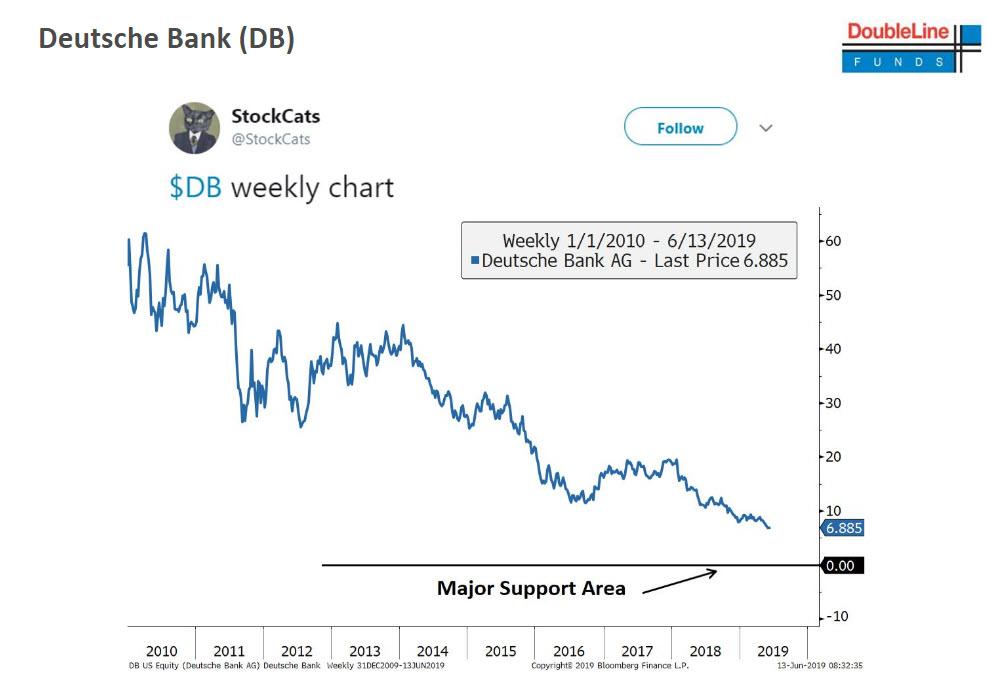

As we noted at the time, it would hardly come as a surprise that the German bank best known for housing €43.5 trillion in gross derivatives notional (something we first pointed out way back in 2013)…

… would stuff its “bad bank”, known internally also as “the non-core asset unit”, with - drumroll - long-dated derivatives.

More to the point, we said that while this “bad bank” plan was commendable - after all admitting you have a problem is the first step toward recovery - it would fall far short of what is necessary to be ring-fenced from DB’s legacy balance sheet.

Today, Bloomberg confirmed as much when it reported that just two weeks after the original, €50 billion bad bank plan was floated, the German bad bank’s bad banks has already grown by 60%, with about €75 billion “and maybe as much as 80 billion euros of risk-weighted assets will form the basis of bad bank”, a Bloomberg source said.

At the higher number, that’s the equivalent of about a quarter of Deutsche’s total balance sheet; it is also more than 5 times the German largest bank’s market cap, suggesting that absent this critical restructuring shape, Europe’s largest bank by assets is now effectively insolvent.

There’s more: as Bloomberg notes, as part of the most ambitious restructuring plan to be soon implemented by Deutsche Bank, there will soon be a cull of top leadership and “better visibility on how many jobs will be cut.”

And while the fact that at least two board members are expected to depart as part of a reorganization aimed at stemming the German lender’s downward spiral, what is more shocking to DB’s rank and file employees is that the number of workers to be cut has also grown in the past 2 weeks, rising from a prior range of 15,000-20,000, to 18,000-20,000, which at its high end means more than one in five jobs will be terminated.

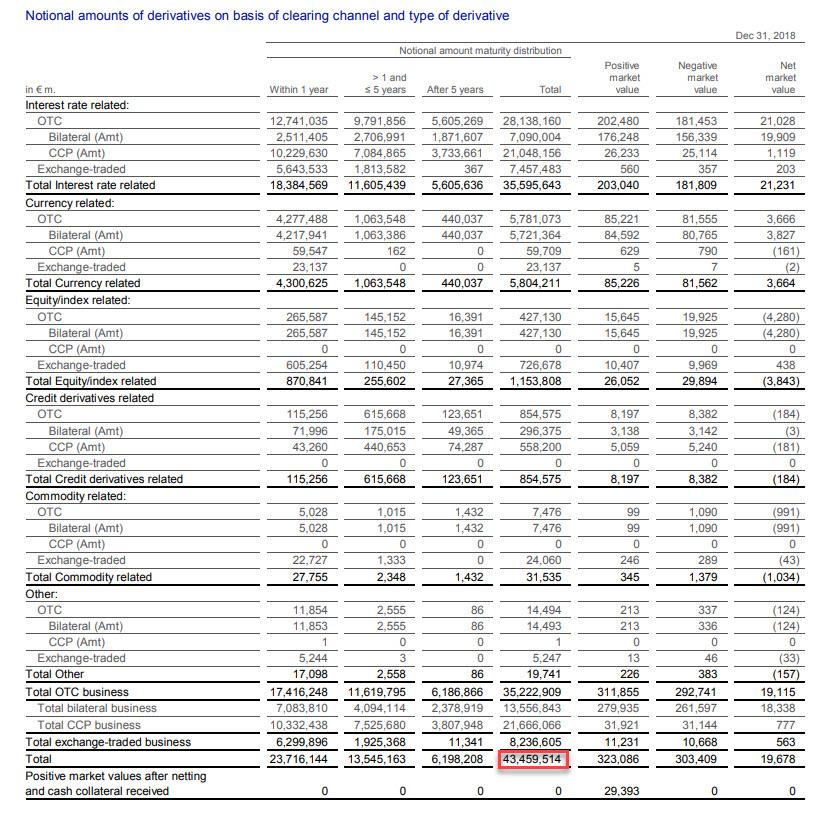

As reported last week, investment bank chief Garth Ritchie will be quitting, while the departure of two fellow board members - retail head Frank Strauss and Chief Regulatory officer Sylvie Matherat - will be announced as early as Sunday, and as many as two new members will be added. Strauss - who was on Deutsche Bank’s management board for just less than two years, and was previously CEO of Postbank, a German subsidiary of Deutsche Bank that it previously wanted to sell but decided to keep in 2017, will be replaced by Karl von Rohr, the chief administrative officer.

According to Bloomberg, the mass layoffs will also include numerous executives below the management board level. Stefan Hoops will be promoted to head a new division, probably comprised of the transaction bank and the lender’s commercial-clients unit, and Mark Fedorcik will oversee the investment bank. At the same time, DB’s debt chiefs Yanni Pipilis and James Davies may also leave.

Finally, the current transaction bank chief, Stefan Hoops, will be in charge of a fourth core division that Sewing plans to create. The proposed transformations are shown in the table below:

All this and more is expected to be announced on Sunday, when CEO Christian Sewing will announce the largest restructuring in recent history which along with deep cuts to the investment bank, will also involve reorganizing the company’s divisions to boost the profile of the transaction bank as well as a shake-up of the management board.

Meanwhile, in a separate report, Bloomberg also details the vast strategic transformation that is about to be unveiled by the bank just short of its 150th anniversary, as Deutsche Bank seeks to “return to its roots” - as part of the overhaul, DB will sever many ties with institutional clients - one of the bank’s key income sources - while seeking to boost its appeal to domestic corporations.

Sewing plans to slash headcount, drastically cut securities trading outside Europe, create a new division for transaction banking services and another unit to hold unwanted assets, shake up the bank’s top leadership and cut the balance sheet, people familiar have said.

“It’s a difficult adaptation process within Deutsche Bank,” Annegret Kramp-Karrenbauer, the head of Germany’s largest political party CDU and a former contender to succeed Chancellor Angela Merkel (until Merkel had a change of heart two months ago), said Saturday in a Bloomberg TV interview. “All those responsible are currently trying with much focus and responsibility to move along, and I really hope that this process leads to success.”

The biggest change will be observed at the investment bank, which accounts for roughly half of Deutsche Bank’s revenue and was a major actor in its downfall; it will be broken in two. The transaction bank will be lifted out and merged with the commercial clients segment that’s currently within the retail division.

The change is designed to accelerate the shift of Deutsche Bank’s focus away from acting as the first port of call for institutional clients such as asset managers and hedge funds toward becoming the primary bank selling cash management, trade finance and hedging products to corporate clients. The new division, to be lead by current transaction bank head Stefan Hoops, will be at the heart of the lender’s future business model.

The securities business will be shrunk, perhaps drastically. Sewing wants to slash equities trading and parts of the fixed-income business. Those assets will be placed in non-core unit to sell or wind them down. The U.S. operations will be particularly hard hit, with the bank getting ready to start rolling out the job cuts on Monday, people familiar with the matter have said.

The decision to pull the plug on a big part of securities trading effectively ends a 30-year effort to become a global trading powerhouse that kicked off when Deutsche Bank took over London-based investment bank Morgan Grenfell, and culminated with Edson Mitchell, who joined the bank in 1995 as head of its global markets organization, and took it from an also-ran in trading bonds, securities and foreign currencies to a major and highly profitable player in those activities (Mitchell died in December 2000 in a plane crash in his private Beech 200 aircraft).

Deutsche Bank’s subsequent acquisition of U.S.-based Bankers Trust a decade later, briefly turned the German lender into the world’s biggest financial services company and set it on a course to become the largest buyer and seller of fixed-income securities as well.

Unfortunately, all DB has to show for that brief moment of glory is one of the largest gross derivative books - which in the past decade was well over 50 trillion euros - in history.

* * *

So will the latest wholesale restructuring help DB become viable?

Probably not: JPMorgan recently estimated that Deutsche’s US operation was losing 25 cents for every dollar of business it does and its global equities business alone loses about €600m annually.

There is one final problem: in the summer of 2016, just a month before fears about the viability of DB sent its stock careening lower and prompting Angela Merkel to discuss whether or not DB will be nationalized, the IMF found that Deutsche Bank is “the bank that poses the greatest risk to the global financial system”:

Network analysis suggests a higher degree of outward spillovers from the German banking sector than inward spillovers. In particular, Germany, France, the U.K. and the U.S. have the highest degree of outward spillovers as measured by the average percentage of capital loss of other banking systems due to banking sector shock in the source country.

Here is the IMF’s chart showing the key linkages of the world’s riskiest bank:

Since then, the gross notional value of derivatives on DB’s balance sheet has indeed shrunk, but so has its equity market cap… which has never been lower and the buffer to absorb losses is virtually nil - DB’s market cap is now just €14 billion, roughly the same as the recent IPO star, Chewy. Which makes sense: as we said two weeks ago, “one creates dog shit, the other is collateralized by it.”

So should things turn bad, it is virtually certain that Germany’s taxpayers will once again be on the hook for the most important bank bailout in European history.

But the biggest irony of all, is that Deutsche Bank may actually have a chance of survival… if only the ECB were to ever hike rates. As it stands now, however, with the ECB set to cut rates in the near future and possibly resume QE, the Frankfurt banking giant is as good as