#HATJ-

From: HEATHER ANN TUCCI-JARRAF

To: BZ Riger

Date: 3/3/2024 10:06:38 AM

Subject: RE: $425M in World Bank catastrophe bonds set to d

There was talk amongst the staff about investing in the monetary instruments/investments that funds were offering to the general public here…

On paper, former majority “owner” of the World Bank (special instrument of the United Nations) being United States…with former majority owner of United States being China …who “heads” the World Bank at the moment?

Thank You, BZ…love you…love all.

—-Riger, Bz on 3/3/2024 1:06 AM wrote:

$425M in World Bank catastrophe bonds set to default if coronavirus declared a pandemic by June

Investors betting big against catastrophic diseases are watching the World Health Organization closely as insurance bonds tied to whether the organization labels COVID-19 a pandemic are set to mature in June.

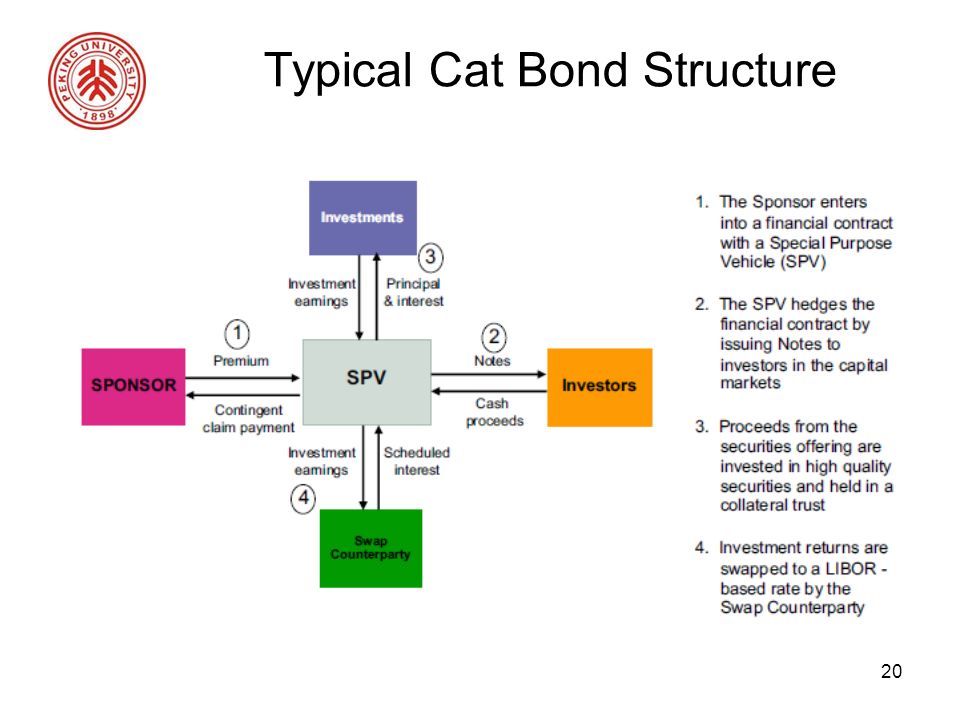

In 2017, the World Bank designed a new way to raise money: Pandemic Emergency Financing bonds. Over $425 million worth of such bonds, which bet against a global outbreak of infectious diseases and will default if WHO declares the coronavirus a pandemic, were sold by the World Bank in its first-ever issuance of catastrophe bonds. In the event of no pandemic, investors would be paid a healthy annualized return. Meanwhile, the World Bank could use the bonds to insure itself against the risk of a global outbreak.

“As an investor, we do not want to lose money,” said Chin Liu, a portfolio manager at Amundi Pioneer, a Boston-based firm that purchased the bonds as a way to diversify the company’s $1 billion catastrophe fund. “But then, we also understand if it’s unfortunately triggered, it benefits every single person, including ourselves, to keep the virus controlled.”

For large-scale investors looking for above-average returns in a bloated market, the bonds were the next logical place to hedge against disaster. At the time of issuance, then-World Bank President Jim Yong-Kim heralded the bonds as an opportunity to leverage “capital market expertise to serve the world’s poorest people.”

The bonds were administered in two tranches, with Class A bond investors receiving a return of 6.9% annually. Class B bond investors received 11.5% annually. The World Bank raised $225 million in Class A bonds and $95 million in Class B bonds.

The investors, mainly endowments and pension funds, have long bet against natural disasters such as hurricanes, but the 2017 issuance of the bonds marked a shift in the market. Before, investors were betting on the wind speed of hurricanes, but now, they were betting on the likelihood of an infectious disease that could tear through nations across the globe.

“This marks the first time that World Bank bonds are being used to finance efforts against infectious diseases, and the first time that pandemic risk in low-income countries is being transferred to the financial markets,” read a statement from the World Bank at the time of issuance.

The conditions under which the payout on bonds will default are staggered based on how rapidly the disease spreads, the number of deaths associated with the illness, and whether the virus crosses international borders.

As of Wednesday, the coronavirus has claimed the lives of more than 2,500 people and infected more than 80,000, with most cases contained to mainland China. This week, the illness has begun to spread outside of China — with more than 100 cases reported in Iran and a run on stores in Italy after the number of infected patients increased 45% on Tuesday alone.

…who “heads” the World Bank at the moment?

the formerly undisclosed majority principal of the Bank for International Settlements?

;- ) that would be my take… lol as the frequencies of absolute Love and Transparent Reveals flow into Knowing

(heart) I Love You ~ sending joyous energy, ribbons of excitement, and sweet simple Fun. 🙂 bz and keegan

https://www.zerohedge.com/geopolitical/us-coronavirus-cases-pass-1000-national-guard-arrives-new-york-washington-bans-large

Within the article it is noted, that in regards to WHO: “Just like that; All the $425 Million Bonds got triggered”

More info as to the structure of the situation for bondholders here: https://www.zerohedge.com/markets/here-are-425-billion-reasons-why-who-refuses-call-covid-19-outbreak-pandemic